Steps to adventuring on travel hacking through credit cards as a hobby

- If you are in credit card debt, stop and do not pass go. Focus on paying off your credit card debt, as this is a hobby that will cost you money, not earn you perks, if you can’t pay off your balance every month.

- Make sure you have a credit score above ~720 or so. You can find out by getting your free score from Discover (without a discover card) or getting your “FAKO” score from creditkarma.com.

- If you have a new credit file or score below 720, the best starter cards are usually the Chase Freedom and the Discover It. If you use them responsibly for about 8 months to a year you will build up a credit file. If you are a student there’s also a Discover It Student and Capital One student card if you’re a student.

- Know how much you spend in a month on credit card spendable expenses. You need to hit this for minimum spend. This could be high if you get reimbursed for work expenses or could be low. Generally you need about $1,000 of expenses a month for most cards at a minimum, but there’s a few ways around it but you may have to pay a small fee.

- Set up accounts with all the majors airline rewards perks – even if you don’t think you’ll use them. For keeping track of your different accounts, use a password management software (I use 1password). Even if you never are going to stay at a Hilton, for example, you still want an HHonors account.

- Determine if you’re under 5/24 Chase rule. If you have opened five or more new credit card accounts in the past 24 months, you won’t be approved for a new Chase card. If you’re still struggling to understand that, check out this post.

- If you’re under 5/24, here’s a great flow chart to follow that was recently updated.

- If you’re not under 5/24, look at the current offers google chart that lets you see the crowdsourced best offers. It helps to know what kind of perk you’re working towards: companion pass on Southwest Airlines? An economy international flight to Australia? One of the fancy suites in the sky on Singapore Airlines or Emirates? For any kind of perk, it helps to do your research on the best partners.

- Find a sign up bonus that you like, apply, and start working towards that minimum spend!

- KEEP TRACK! You don’t want to miss that minimum spend by a day or a dollar!

- Once you’ve gotten those sign up points, decide what to do with them!

Links mentioned

- My Full Budget from my 13-country trip, including the travel hacking

- Current credit card offers google spreadsheet

- Reddit.com/r/churning/ – The best place to ask newbie questions, it’s less scary than other parts of reddit, I swear!

- For more advanced folks, https://www.flyertalk.com/ has a forum that’s a great place to go but it’s not very newbie friendly

- CANADIANS: http://www.canadiantravelhacking.com/

- AUSTRALIANS: https://maketimetoseetheworld.com/point-hacks-for-australia/

- UK folks: https://www.nomadicmatt.com/travel-blogs/travel-hack-united-kingdom/

We finally have a forum! Join us at forum.ohmydollar.com is a great non-judgemental place to ask questions or participate in our daily check-ins and challenges. It’s really quite fun. Most of the forum is hidden from view, so register to see more!

Ask us a question!

We love hearing from you! Email us your travel hacking stories or other financial thoughts at questions@ohmydollar.com or tweet us at @anomalily or @ohmydollar

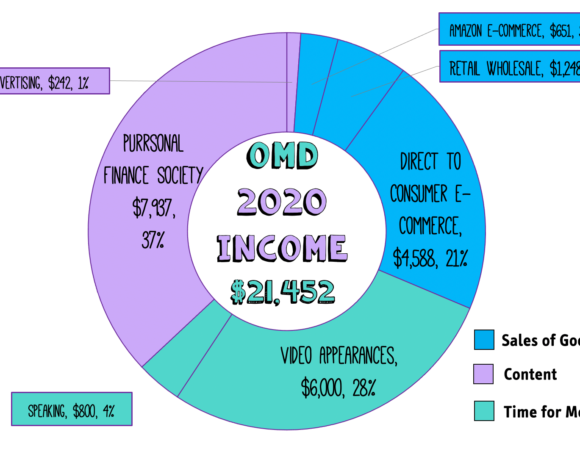

This show is made paw-sible by listeners like you

We absolutely love our Purrsonal Finance Society Members, the folks that generously support Oh My Dollar with $1 or more a month on Patreon – and have made is so we have free, full transcripts for every show on ohmydollar.com. This episode was underwritten by patron Tamsen G Association and Warrior Queen. To learn more about being part of the Purrsonal Finance Society and get cool perks like exclusive livestreams and cat stickers, you can visit ohmydollar.com/support

Other Episodes You Might Find interesting

- How To Conference Travel on the Cheap

- My budget: world travel and 45% savings rate on less than $40K income

- What Money Goals Should You Focus on?

Full Transcript provided by our Patrons

How I world travel for cheap with travel hacking.mp3 (transcribed by Sonix)

Will Romey: This show is supported by generous listeners like you though our Patreon.

Will Romey: This episode is underwritten by the Tamsen G Association and Warrior Queen. To learn more about ways to support Oh My dollar! and get cool perks like exclusive livestreams and cat stickers you can visit ohmydollar.com/support

Lillian Karabaic: Welcome to Oh My Dollar!, a personal finance show with a dash of glitter dealing with money can be scary and stressful. Here we give practical, friendly advice about money that helps you tackle the financial overwhelm. I’m your host, Lillian Karabaic.

Will Romey: I’m your other host, Will.

Lillian Karabaic: So Will as the show airs as it is in people’s ears I will be in Japan.

Will Romey: Cool.

Lillian Karabaic: And I am going to be staying in some pretty cool hotels. Like one of the hotels I am staying in is where all of the beds are actually beds from actual first class train compartments which I’m like as a train nerd. I’m very excited about. And then I’m staying and like an actual a cool art capsule hotel.

Will Romey: Very cool.

Lillian Karabaic: I’m staying in a hotel where all of the staff are robots. Yeah like the people that check you in and everything are actually weird humanoid robots. Anyway.

Will Romey: Creepy, but OK.

Lillian Karabaic: I’m staying in a

Will Romey: I hope that goes well for you.

Lillian Karabaic: I’m staying in a lot of weird hotels and I did not pay for any of those hotels myself. I got all of those hotels using points.

Will Romey: So you’re a hacker.

Lillian Karabaic: I am a travel hacker. Which is kind of a weird hobby. So quick shout out if you want to see those hotels you can go check out my tiny tiny YouTube channel where I post videos every Monday and I’m going to post some reviews and like walk-throughs of some of the weird hotels and I’m going to be staying at including just like a classic Japanese capsule hotel. So if you’re interested in that you can go check out my youtube channel at youtube.com/anomalily. I’ll link to it in the show notes.

Will Romey: So what really is travel hacking. I feel like you’ve mentioned it a couple times over a few episodes. We never really kind of dug into it.

Lillian Karabaic: Yeah. So we we’ve talked about it briefly before on the show but mostly what I said is it’s a really complicated hobby and it’s kind of hard for me to explain to you on the air. Well two years after that initial episode aired I figure maybe it’s time for me to actually start to try to explain how I travel hack. So what travel hacking is is specifically it isn’t just looking for cheap flights or you know being good at you know finding mistake fares and stuff like that like that is a form of getting cheap travel. And I’m also a fan of that. I am actually flying to Japan on a very cheap flight that I got because I’m I do a lot of alerts for cheap flights I’m doing 500 dollars round trip to Japan which is pretty obviously a deal. But what travel hacking specifically refers to is the practice of using credit cards and rewards programs to get travel rewards and these are usually specifically credit cards and bank accounts with like travel sign up bonuses in order to get travel rewards. And some people just casually do this which wouldn’t be described as travel hacking.

Will Romey: They just happen to use the credit card.

Lillian Karabaic: They have a card and maybe have one but then there’s some people who like me who take it very seriously. What I will say is that I am by no means an expert. I am someone who has been doing this for several years and I’ve gotten first class you know tickets in airplanes for 200 dollars where they would have cost me twenty thousand dollars and I got my own set of pajamas that I got to take home and a toiletry get an eight course meal served with white gloves in the plane it was all crazy. So like I’ve done a lot of that my big trans-Siberian trip I paid for mostly with Chase Sapphire reserve points and I’ve posted the full budget of that on the website.

Lillian Karabaic: So I’ve done a fair amount of this like I’ve probably gotten close to like 8 or so free international flights using travel hacking. That being said there are people that are way more intense into it than I am. So I will do my best to kind of explain the basics of this hobby. First thing I’m going to say is that this is a hobby. The reason I keep using the word hobby is this is not like a casual thing. I’m not recommending that you do this as something to just like dabble around with. I’m also not saying in any way this is a required part of financial wellness. This is literally like it’s a hobby. I spend a little bit of money on it and I also get a lot of benefits out of it. And it’s something I do for fun.

Will Romey: Yeah.

Lillian Karabaic: All right. What I do like about it is I do think it makes luxury travel like a great equalizer because if you’re willing to play the game and monitor and play it middle class and lower income people can actually have access to like flights to Hawaii like one of the big barriers for a lot of people with travel that are interested in it ends up being money. And if you’re willing to do this it is something that you can do to really make these cool travel experiences be accessible to you like there’s no way I ever would’ve spent twenty thousand dollars on a plane ticket but I got that experience.

Lillian Karabaic: I have my own feelings about the climate and why it was totally unreasonable for me to do that. But I yeah all my airline miles I’m just going to say I’m I’m going to environmental hell. So what I will say is this is not for you if you’re just starting out to build credit. And it’s also not for you if you don’t like keeping track of things or dealing with a bunch of applications this is probably not a hobby for you. If you’re the kind of person that doesn’t track their spending in some sort of way this is not this is just not a hobby for you. You probably won’t enjoy it and you likely won’t get a lot of the benefits for it.

Will Romey: Right.

Lillian Karabaic: So it also tends to be pretty U.S. based. I obviously I’m U.S. based majority of our listeners are U.S. based. If you are a Canadian or U.K. there are different credit card hacking that you can do and I will link to two resources for it. But I know very little about it because obviously I am not Canadian or in the UK.

Will Romey: So it’s topical to you.

Lillian Karabaic: Yeah but but this will give you a general idea of how this concept works. So a way a lot of people just ask me as they see that I get these these travel perks and they’re like OK what credit card should I get what credit card do I sign up just so that I can get all of this. And I’m like oh it’s not that easy. So the way that that this works is that there’s a couple different components. So I’m going to focus on travel perks. You can also do kind of credit card hacking to just get cashback or general cashback or like you know some sort of rewards that you can use for like shopping and things like that or you can use them for like gas points and stuff. But I’m going to focus on the travel ones. So travel there’s really kind of three general categories of things you can focus on there’s these flexible points and these flexible points are often redeemable for a bunch of different kinds of travel so it could be used for hotels can be used for planes and it can usually be used for a lot of different partners. And then there’s another kind of points which are tied which are like free nights and those are tied to hotels.

Will Romey: Okay.

Lillian Karabaic: And those are usually tied to different types of hotel chains and then not quite last but least. But let’s say last but least there is directly tied to individual airlines and those are going to be co-branded cards that are the Alaska cards and the Southwest card. The thing to understand about these cards is that they all have their own advantages but they also all have their own rules about who can sign up. So usually to get into credit card hacking as a hobby you need to make sure you have a credit score above, say, 720. You need to have the best credit score in order to get these cards because these are considered premium cards. When you sign up you are looking for cards that have a high sign up bonus but you have to know the relative valuation. So 50000 Delta miles is very different than 50000 Chase points. And if you think about them only in terms of the point value you’re gonna be totally lost out because they all can be used in different ways.

Will Romey: The points aren’t necessarily a standard unit of measure.

Lillian Karabaic: Not a standard unit measurement and even Miles are like you said Miles seems intuitive but it’s not. So there’s things to know about yourself when you’re kind of thinking through what kind of card do you want to get. If you’re someone who does stay in a lot of hotels already and you already have a lot of alignment with a particular program you might want to go for program card. So like I have an Alaska card because I fly Alaska all the time because they’re the biggest they have the most direct flights from Portland. I live in Portland. I fly Alaska constantly because of that. I have an Alaska card because those points are very valuable to me. I also think Alaska is a really valuable program. I actually use most of my Alaska points that I accrue not on Alaska Airlines because they have a lot of partners so I’ve gotten free flights on Emirates to Dubai and to Europe and things like that. So that’s just my like hat tip for I love Alaska.

Will Romey: And they serve beer on all their flights going in and out of Portland.

Lillian Karabaic: Very important. And any other things about about those individual programs is that’s good, but you have to consider the next step which is what the individual banking rules are. So in addition to figuring out your individual value and what kind of things you want you also need to figure out can you apply for this card. And if you do apply for this card what the relative valuation is going to be. So once you do find a card they’re going to have different sign up bonuses. One of the things to know about sign up bonuses for individual cards is that usually when you sign up for the card you either get instantly approved or you’ll have to wait a bit and they’ll like send it to you in the mail. When you get approved the clock will start and you usually have 90 days. Sometimes you have two months from the day that you get approved for the card to spend a minimum amount of money. Obviously this hobby is only for you if you if you are going to be able to pay off your balance every month quite often the minimum amount of money is you need to spend a thousand dollars or two thousand dollars or three thousand dollars. Some of the higher cards can go up to four or five thousand dollars within three months of opening the card. If you missed that by a day or a dollar you will not get those sign up bonus points.

Will Romey: You got into it like totally to the letter.

Lillian Karabaic: Yeah. And they they aren’t keeping track of it for you. Yeah you’re keeping track of it for yourself. Which is why it’s really important that you be organized with this and we will get to if you’re like Oh my God I don’t spend five thousand dollars in three months. How will I do it. We will get to one of the ways to do that because obviously as someone who is very frugal and has pretty low expenses. There’s a lot of different ways that you can kind of try to figure this out. Some are just figuring out how to time your purchases. And then one of the other things you can do is this thing called manufactured spending which is very complicated. We’re not going to get into it on the air. I will link to show notes. It changes constantly. And that’s essentially where you spend money that you then get back in cash. But it’s it’s not money laundering. But it feels kind of close to it. So I don’t necessarily recommend a manufactured spend. So when you’re trying to figure out how how to apply for what kind of card to apply for one thing you need to know are these kind of basic rules of credit card hacking. Remember how I said this was complicated? It is complicated. So the big rule that you will see referred to constantly when you first start to dive into this is something called 5/24 otherwise known as the Chase 5/24 rule that it is commonly called in the miles and points community. Even if you have a perfect credit score it isn’t enough to get you approved for many Chase rewards cards. And one of the reasons this ends up being important is because a lot of the rewards programs are tied to Chase. Chase as a bank has a lot of these rewards cards. They also have these things called Chase Sapphire points which are very flexible points which are good if you’re someone that doesn’t want to be tied to an individual airline or you’re someone that doesn’t want to get tied to an individual seat or blackout dates because a lot of those individual airline cards will have blackout dates for their own programs. But the Chase ones you can just use for their portals so they’re great if you have a specific time or location that you want to go to. The Chase 5/24 rule says that if you’ve opened five or more new credit card accounts in the past 24 months you will not be approved for a new Chase card. So this is super important. If you start playing this game if you are under 524 meaning you’ve applied for less than five cards in the past 24 months which generally we’re beginning out in this you won’t have.

Will Romey: Because you just got a zillion credit cards instead of paying them all off of each other something.

Lillian Karabaic: Yeah. I mean so I have I have more than I have hit 5/24 and that’s because I regularly open new cards to get travel hacking bonuses which is why you want to do these Chase cards before you do other cards because Chase has these rules.

Will Romey: Yeah.

Lillian Karabaic: One really important thing to know is often you can get sign up bonuses for adding an authorized user to your credit card. But Chase counts authorized user accounts as a other 24. Yes. So that is important if you want to get those bonus points for adding an authorized user. Wait until you’re done applying for all of the cards that go under 5/24. So if you’re early in your process of travel hacking you generally want to sign up for them. If you don’t have a great credit score yet because you haven’t you know taken out a lot of debt or because you’re rebuilding your credit usually you cannot get approved for some of these fancy or Chase cards. The two best starter cards I recommend if you’re trying to just build your credit and get into the travel hacking game are usually the Chase Freedom Card and the Discover It card and I don’t recommend them because I get kickbacks on either of those. The reason I recommend them is that they tend to have relatively low credit limit credit limits on them which means that there’s like a low maximum that you can spend. And if you use them responsibly for several months to a year you’re going to build your credit file if you choose the Chase Freedom. You’re also going to build a credit file with Chase which means you’re more likely to get approved for those at the Chase card. Those chase very good if you are a student. There’s a Discover It student and a Capital One Student Card and you almost always will be guaranteed to get approved but you can also possibly get approved for that Chase Freedom. So those student cards. If you get denied for that once you’ve applied for your first card it’s not over. The game is not over. There’s this line called a recon line or reconsideration line and you can call them and you can say why wasn’t I approved. Why don’t you love me. And sometimes they will say you’ve hit 5/24 or something like that. But they also might just say oh we don’t know a lot of information about you and you can say would you approve me for a lower credit limit or they’ll ask you more information about like your income or documentation because they don’t know about you. Chase in particular. And the reason I bring them up is because usually you’ll do those early. Chase in particular if you get to the recon line, it’s usually pretty common that you can shift things around. Once you get deeper into this often you will get rejected when you first apply for a card and you call the recon line and they just say like you already have so many cards with us we don’t want to extend you any more credit. And what you can do is you can move some of your credit limit from one card to the new card. So if you already have like ten thousand dollars of an available credit limit at Chase and you apply for new Chase card you can say “Hey can I move five thousand dollars of that to the new card”. And this isn’t me moving 5000 dollars I owe them. This is just the possibility that I could owe up to them. And that’s because they don’t want to double the amount of money that I could borrow from them.

Will Romey: Yeah yeah yeah.

Lillian Karabaic: Does that make sense?

Will Romey: Because they’re trying to recoup their credit they extend.

Lillian Karabaic: Yeah exactly. The Chase cards are Inc Preferred, Chase Sapphire Preferred, and Chase Sapphire reserve and Inc Preferred is a business card. However if you have any side gig at all that you have any 10-99 income for you are a business and you can apply for a business card. OK. So that’s kind of important to know. So there is a flow chart that walks you through if you haven’t hit 5/24 what you should do. It is from the churning Sub Reddit. I’m not going to say it’s beautiful because this is a complicated hobby but I will link to it in the show notes as kind of a flow chart to help you figure out what they are.

Will Romey: Or scare you away from this as a hobby.

Lillian Karabaic: Yeah or scare you away from this as a hobby. So if you are considering doing this, figure out if you’re under 5/24. Then figure out if you want the SW companion pass. So Southwest has a very particular thing called the Southwest companion pass that actually allows someone to fly for free with you if once you hit a certain amount of minimum spend and certain amount of points on that card and it is tied to a particular card. So if you are… but it is a the Southwest card falls under 5/24 and so you want to do it early with those other Chase cards. And if you don’t want that. So like I don’t fly Southwest very often it doesn’t go to most of places I go to. So the companion passes not that valuable to me but this is where it is helpful to know that.

Will Romey: Right to know what you’re specifically after with the school. Yeah.

Lillian Karabaic: Yes. So once you’ve kind of figured out what kind of card do you want to do. I told you this was complicated this is so hard to explain on the air so I’m going to have very detailed units for this. Once you figure out you want to do that you want to hit the minimum spend. So what I recommend is the very first time you do a card that you’re trying to do for travel hacking. Just do one. So let’s just do one track. That minimum spend. Make sure you can do it. Make sure you can hit it. The other thing that I recommend is to not sit on too many points so I know a lot of people who like to brag about like I have a million frequent flyer miles. Here’s the thing. These programs constantly get revised and updated and usually when they get revised and updated your points only get less valuable. They rarely make them more valuable they almost are constantly doing devaluations. The good news is they usually announce those devaluations pretty far out in advance so if you are keeping your finger on the pulse of these things you will know if your points are gonna get devalued. The downside is if Delta for example they’re constantly devaluing their points and the Delta sky miles. If a new devaluation gets announced then suddenly there’s a rush of people trying to use their tickets and you’re going to hit all those blackout dates and all of those seats are gonna fill up.

Will Romey: Oh that’s interesting.

Lillian Karabaic: So it’s very important to know that. One of the things if you’re looking for doing premium tickets so if you’re really interested in doing premium international tickets so you want to fly in business class to you know New Zealand or something. It would be a six thousand or ten thousand dollar ticket. Normally the best value you’re usually going to get you’re going to want to actually want something tied to an individual airline because those flexible points tickets like the Chase ones that I mentioned they’re great because they don’t tend to have blackout dates but they correspond to the value of the ticket so they’re not good for those premium tickets. Those are much better if you can convert those into a zone based value so a zone based value says like it cost sixty thousand of our points in order to get a one way business class ticket between Zone 1 which would be the US and Zone 9 which would be Southeast Asia, right? And these are these complicated charts. And if you want to find them all you have to do is google up Google the reward system and then say award chart and you’ll be able to finally see how this complicated chart these very complicated charts but it’s very helpful to know.

Lillian Karabaic: So I rarely apply for a card without knowing what trip I want to tie it to. So I just got ninety thousand Chase points for the Chase Inc. Card for my business and I know that I’m going to spend that on an Australian ticket. And the reason I’m doing that is because Australian tickets are one of those things that it didn’t make a lot of sense to be able to do it from the flexible portal. But those Chase points I can convert convert to Chris flyer. So here’s the other thing. Even all of these points. So Alaska is a great example. They have what are called partner award partners. So when you find an individual airline you could also look up with their award partner charts are and usually you can take your miles and convert them for an award partner. I like Alaska because you can actually shop their award partners on their own website but a lot of these you need to actually take your points, transfer them and there is this terrifying 24 to 72 hour period where your points disappear from one account and don’t appear in the new one and you have to just be like I hope I didn’t lose my seventy thousand points of signing bonus.

Will Romey: That would be a bummer.

Lillian Karabaic: And so you you want to do your research on this. A lot of people generally are like what has the best sign up bonus. The thing is these change constantly. They change all of the time.

Will Romey: So whatever you say it’s going to be out of date.

Lillian Karabaic: Whatever I say is going to be totally out of date. So what I use is I use this giant crowdsourced spreadsheet that everybody used. I will link to it in the show notes. It’s essentially all the people that do this as a hobby crowd fuel what the best current offer is what the best offer has ever been for that card and what the minimum spends are in everything in this massive crowdsource thing. But what’s important is to know if they are 5/24 or anything like that. I know a lot of people hear this and go like “oh my god but isn’t applying for these cards are going to hurt my credit so much?”.

Will Romey: Probably.

Lillian Karabaic: Actually no. So generally your credit will improve with this kind of hobby over the long term because you’re gonna have more and more available credit. So as long as you pay it off every month. So I’m a big fan I always pay mine off before my statement balance date so it gets reported as zero dollars which means my credit utilization is very low. Utilization: how much of your credit that’s available to you that you’re using is a part of your score. So I report as using zero percent of my available forty thousand dollar available credit I think. Okay. I think at this point I have like one hundred thousand dollars between all of my cards available credit to me I charge about 500 dollars a month on generally on a card and I pay it off before my statement balance date so I’ve 0 or 1 percent utilization and that is good as one of the key things that they’re looking at.

Lillian Karabaic: Remember this whole credit game is one they have a couple goals. One is that they don’t want you to pay off your bill every single month and they want you to pay interest and they want to make money off you. The other is that they don’t want you to keep track and they want to charge you an annual fee because you don’t cancel the card after a year and 3 they want you to use their card. The whole point of the credit system is to benefit lenders it’s not meant to benefit you and it’s meant to say, Are you a good risk for lending money to. But obviously if you’re someone who’s taking a lot of different credit instruments they like you. As long as you’re not running running out on their bill. So remember this whole credit system kind of feeds into each other. All right, so if you’re like Oh my God I’m already overwhelmed. Here are the basic steps for getting this setup. First step set up accounts with all of the possible rewards programs even ones you might not use.

Lillian Karabaic: So there is kind of a full list of a bunch of those award programs. This where I really recommend a password manager.

Will Romey: Yeah always.

Lillian Karabaic: The reason you want to set up your own airline and hotel accounts is that you should go to the company website and create those loyalty accounts first. You might get a better offer. Often you can get a sign up promotion for those credit cards when you apply for the loyalty card. The other thing is you want to apply your loyalty account number as part of the credit card application so that it’s always tied. You don’t want them to end up with them creating multiple loyalty accounts for you which does happen and then it’s like a mass of confusion. The other thing is that some credit card offers are only for existing members. So you just want to do that you want to create accounts in all the different password managers.

Will Romey: Oh so you’ve already got an existing account.

Lillian Karabaic: Already got an existing account before you do it. If you’re the sort of person who doesn’t like to do research then you can just apply for a single card with a sign up offer you like. So I would recommend that you stick to the cashback or fixed value cards. If you don’t want to do this as a hobby just find one of those cashback cards like the chase freedom or something like that. Apply for it. There you go. Done. Find the sign up bonus that you like. You know look for the current offers chart and find it. Then if once you’re trying to hit that minimum spend you’re like oh my gosh how am I going to spend. I know I spend less than than a thousand dollars per month and I need to spend three thousand dollars in 90 days. A couple different things you can do. One prepay expenses. So if you’ve got tuition fees coming up if you have kids summer camps you can prepay large expenses if you need to buy any equipment for work. So I always try to plan the big sign up bonus cards when I need to replace a laptop or camera equipment. Any sort of large equipments I prepay on an annual basis so that I save money all of my business expenses. So I also try to do it before the end of the tax year so I will pay annual fee subscriptions for all of my business expenses like my software and things like that.

Will Romey: So you can just sort of knock all those out at once and pay them off.

Lillian Karabaic: Yeah as long as you have that money available then I not only save money on them but I also can use that towards the annual fee. Another thing you can do is if you have a very trusted friend that does have a lot of expenses. You could have them put expenses on your card and then pay them back. I have done that occasionally like when my partner has to book a lot of very expensive hotels I’m like “Can you book that fourteen hundred dollar hotel stay on this card for me and then pay me back because I need that to hit my minimum spend.” If you are like oh my gosh there’s still no way I can hit it. One of the things I do is I pay a slight cost. Like I said this is a hobby did cost me a tiny bit of money. I actually pay my rent via a credit card on the month that I need to hit a minimum spend. So I use this website called plastique. You can also use something like Venmo and pay the extra fee right you to pay back 2 percent had a return to pay by credit card and so usually you can get the transaction fee to be less than two point seventy five percent but if that’s going to mean the difference between me and ninety thousand miles which I can use for a twenty thousand dollar ticket that 30 dollars I pay per month to pay my rent on the card is worth it to me. You can also set up your student loans and things like that to be paid auto pay on that credit card. The big thing is make sure you keep track of which cards you’re using for which recurring expenses if you’re doing this.

Yeah. This all seems like a really good way to shoot yourself in the foot if you’re not. Yes.

This is why like I said this is not a hobby for the disorganised and it’s totally fine if this isn’t a hobby for you. But when people say like oh I just want to apply for card and get points I say “Yeah just find a nice cashback card you know find one good sign up bonus try it once”. I do think they’re really fun but you do have to keep a really good eye on it so you will get a temporary ding for a card. It’s fifteen point slight dip in your credit score for applying for new credit and that’s true for everybody. When you go out and apply for new credit you’ll get a slight ding. Your credit will recover within 90 days. That’s just a temporary ding because they don’t want you to go out and apply for a bunch of new credit at the time. This is by no means a comprehensive general thing but hopefully this kind of got you the basic starters of what travel hacking looks like. The big things is that you want to know what you’re going to use it for. Are you looking for an international trip. Are you looking for a hotel stay. And then you want to strategize around that and then you need to realize that some of those cards you can only apply for once and you’ve got to apply for them in a certain order and so be aware of where you’re at on that. Last but not least make sure you monitor your credit while you’re doing all of this. This is something where you very much do want to monitor your credit and keep an eye out. If you have a card already please keep your oldest card open because that is going to lengthen the average age of accounts.

Lillian Karabaic: Remember you’re going to drop your average age of the accounts which does have an impact on your credit every time you have a new shorter credit line. So that is important to know. If at the end of the year because often the annual fee for a card is waived for the first year but then it will occur common for rewards cards is a fifty or seventy five dollar fee on the higher end of cards like the Chase Sapphire Reserve which has a $450 annual fee which is sounds crazy high but you also get 300 dollars a year you can use towards travel so it’s effectively a one hundred fifty dollar one.

Will Romey: Right.

Lillian Karabaic: But you also get like lounge access and stuff like that and so it ends up making sense for people that travel a lot. The big thing is if it’s waived for the first year keep an eye on it make the decision: do you want to close that account or not. Is it worth that extra fee to you. If it isn’t and you don’t want to close the account what you can do is call and ask for a product change to a no fee card and a product change means the leave the same line of credit open which means it will continue to age on your credit score but you will downgrade to a card that has no annual fee. You might get less perks but you’re gonna be able to keep that line of credit open and you won’t have to pay the annual fee and you’ve really gotten the sign up bonus hopefully. So yeah.

Will Romey: My eyes glazed over a little bit there.

Lillian Karabaic: I know it sounds complicated and it is complicated. I do want to scare you off from this. I’m saying it’s such a fun hobby if you’re like into spreadsheets you like to get free travel. I’ll post.

Will Romey: The results sound excellent.

Lillian Karabaic: Yeah but it isn’t for the faint of heart. The other thing is like in addition to not being for someone who’s building their credit and just getting started. It’s also on the other side. It’s not good if you’re thinking about applying for a big loan within the next like 6 months to one year.

Will Romey: Right. So you say you’re going to take your average card length down.

Lillian Karabaic: Yeah. You’ll suffer a small hit on your credit in the short term and so if you’re doing something like applying for a mortgage for example just a couple you know 20 points in your credit score can make a huge difference on what interest rate you get offered for your mortgage and that can be tens of thousands even hundreds of thousands of dollars over the life of your mortgage depending on how big it is. So you really want to lock in your credit score at the highest rate possible right before you apply for a mortgage. And so you don’t want to do something where you’re applying for a lot of new credit right?

Will Romey: Yeah.

Lillian Karabaic: Because it makes them nervous because they’re like why are you applying for all those credit. Is something wrong? So that’s just another thing to bear in mind. But you know once you’ve done the mortgage hey once once you’ve got that house and you’ve got the mortgage paying property tax on a credit card is an excellent way to hit a minimum spend.

Will Romey: Yeah. That makes sense.

Lillian Karabaic: So then you can get into the hobby. I hope this was helpful. I hope this wasn’t too overwhelming for folks. Will. Are you excited or you’re just like totally scared.

Will Romey: I’m not gonna do this. Yeah. Have fun.

Lillian Karabaic: I will link to resources in the show notes. I’m not a huge fan generally of Reddit but the sub Reddit for the churning community which is another term for travel hacking is actually really helpful. And so I linked to a bunch of things in the show notes including the updated spreadsheet of the best current offer for sign up bonuses and I will link to the spreadsheet that walks through the flow chart of if you’ve hit 5/24 or not.

Will Romey: I’ll be someone’s travel companion vs. yeah I’ll be that plus one.

Lillian Karabaic: I actually have an Alaska companion pass you want to come somewhere with me?

Will Romey: Yeah.

Lillian Karabaic: Yeah.

Will Romey: Alaska Airlines doesn’t just go to Alaska like it seems like they should.

Lillian Karabaic: It’s true. And they also bought Virgin now so they they own Virgin anyway. If this sounds too complicated for you know what you can do? Follow up cheap airfares and mistake fares and stay away from this whole thing and just walk away slowly and that’s fine that’s totally valid. Yeah. All right. That wraps our show for today. We love hearing from you. E-mail us your favorite travel successes if you’ve done credit card hacking or if you have horror story failures.

Lillian Karabaic: Yeah yeah email them to us. Send to questions to ohmydollar.com. Or tweet us @anomalily or @ohmydollar. Our producer is Will Romey.

Will Romey: Our intro music is by Aaron Parecki, and your host and personal finance educator is Lillian Karabaic. Thanks for listening and until next time remember to manage your money so it doesn’t manage you.

Lillian Karabaic: And check your credit score.

Sonix is the best online audio transcription software in 2019.

The above audio transcript of “How I world travel for cheap with travel hacking.mp3” was transcribed by the best audio transcription service called Sonix. If you have to convert audio to text in 2019, then you should try Sonix. Transcribing audio files is painful. Sonix makes it fast, easy, and affordable. I love using Sonix to transcribe my audio files.