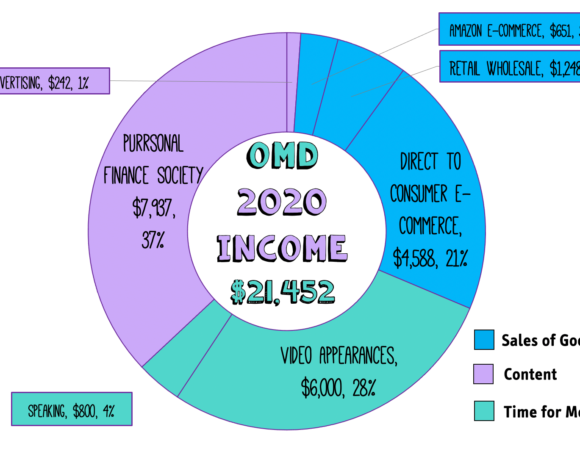

: We absolutely love our Purrsonal Finance Society Members the folks at generously support Oh My Dollar! with one dollar or more per month on Patreon and have made it so we have free, full transcripts available for every single show on ohmydollar.com. This episode was underwritten by patron Tamsen G Association. To learn more about being part of the purrsonal finance society and get cool perks like exclusive live streams and cat stickers. You can visit ohmydollar.com/support

: Welcome to Oh My Dollar!, a personal finance with a dash of glitter. Dealing with money can be scary and stressful. Here, we give practical, friendly advice about money that helps you tackle the financial overwhelm. I’m your producer Will Romey and here’s your host Lillian Karabaic.

: Good morning. As you know, Will, it is health care month on ohmydollar, as it is open enrollment season once again.

: Yes.

: So maybe it has already started for you at your work, or if you are on the exchange in certain states it is going to start on November 1st on healthcare.gov

: So in all states with an open exchange?

: With healthcare.gov exchanges. If they run their own exchange, they might have different – uh – open enrollment dates.

: So we’ll just say November 1st.

: Yeah for a lot of folks. So, this is your warning that once again this episode is pretty U.S. specific. Keep your ears peeled for a bonus episode that is not U.S. specific coming up.

: And you know, Will I think that Trump might have heard about health care month on Oh My Dollar!

: Probably, who hasn’t?

: Because they the administration just passed through a last minute rule change that could mean much much cheaper and junk your health insurance plans are now available. So we scrapped our original plan for this episode so we can talk about this junk health insurance because this is important stuff. Even if you’re not going to get junk health insurance you might want to know about this. It could matter to you.

: So this might be a slightly more wonky episode than normal but you’re going to want to listen if you want answers to the following questions:.

: Why should you care about short term health insurance plans?

: If you can’t find affordable health insurance on the exchange or through work, should you get one of these plans instead?

: Will they be available everywhere?

: What’s different in 2019 about health insurance based on these policy changes?

: How do you make sure that you’re not getting a junk health insurance plan?

: All good questions and pretty important! As always, the first rule is don’t panic. *giggles*

: *giggles*

: So, do you know what junk health insurance plans are?

: Health insurance plans that suck, I don’t know.

: Mainly, their official definition is short-term health insurance plans and they were kind of initially conceived as a way to fill the gap. If you don’t qualify for COBRA, if you’re unemployed, and they were meant to be for only a couple of months. For some people they kind of acted as what we have previously called “catastrophic insurance.” And we’ve talked before about how before the ACA, a lot of people had these what are called “catastrophic plans” that cover basically nothing, but they prevent you from going bankrupt if you were to get something very expensive.

: Right. We did an episode last year around this time, I think.

: Except that we were talking in that case about high deductible plans which are under the ACA still cover a lot of those cool essential benefits that we mentioned before. All those things that you get for free. So that’s your kind of basic preventative care, well-woman exams, mental health treatment – all of these things are now considered essential benefits. And because of the ACA they have to be covered. That means that those “catastrophic plans” didn’t really exist in essence anymore.

: Right, because they had to cover a pretty wide range of things. Essential benefits.

: Exactly. And the other thing that they had is that they could not deny you based on pre-existing conditions and they couldn’t charge you different amounts of money based on what they kind of consider your risk profile. The technical term for this is medical underwriting, and you might be familiar with underwriting when it comes to other kinds of insurance right? So for life insurance quite often you have to go through like a health exam or something like that.

: Right.

: So it used to be that medical insurance very much especially for like small businesses, you, they could determine your rate based on your risk group. So this was called community profiling. This essentially was why if you were in a type of occupation where you were likely to have you were more statistically likely – not you yourself – but your profession or the type of business or industry or region you were in was more likely to have a costly medical cost, than your insurance could be more expensive. So you know a great example of this is do you live in a zip code that has high amounts of cancer because of a terrible water table.

: Not even just people who are deep sea welders.

: Yes. And this is an example I enjoy using because I think it’s kind of interesting. So there was a higher number of gay men who are hairdressers which is actually just statistically true and not just stereotypical, but that meant that getting health insurance for hairdressers was incredibly expensive because of the AIDS crisis and the higher diagnosis of HIV among the gay community in the 90’s and because of that medical underwriting made health insurance based on the community profile of hairdressers – more expensive.

: Wow.

: Like astronomically expensive. And that’s one of the things that ACA eliminated. ACA was essentially like I can’t get charged more money because I am a woman I can’t get denied health insurance because I have rheumatoid arthritis. These short-term plans bring back that old profile. So these short term plans the reason they are called junk plans is because they are kind of there is a stop gap and they can completely – They’re a stopgap only – They don’t actually provide any of these essential benefits in most cases. Very little preventative insurance, this isn’t the kind that you’re going to go use to get you know your regular prescription for 20 dollars instead of 200 dollars.

: So what is covered? Is it just like an emergency room visits?

: It really, really can vary what is actually covered under these. And that’s one of the things, is a lot of the stuff that we talk about on this is how there are very, umm, strict requirements about what does need to be covered under an ACA-compliant plan. But these junk plans, kind of, there’s not a ton of regulation around them.

: And in the past, you would have to pay this penalty, right? The penalty if you didn’t have ACA-compliant insurance right, if you had one of these catastrophic plans because they weren’t considered compliant plans. That being said, as of this week, the Trump administration has made it so that not only are these obviously they eliminated the penalties so in 2019 there is no more penalties, so we expect a lot of people to drop off the exchanges, so the people that were otherwise healthy – which is one of the big concerns – is that this is going to raise costs overall because we’re not going to have healthy people paying into the system, right?

: Right, kind of averaging it all out in terms of costs.

: Yeah that’s kind of the general terror but then the other thing is that the Trump administration this is where the wonkiness comes in. But essentially the subsidies these cost sharing subsidies that the federal government provides to each state they now are expanding the type of waivers – the Innovation Waivers are what they’ve they’re called that each state can have in order to essentially use some of make these short term health insurance plans possibly available via the exchanges or maybe even pass some of the subsidies through for people on these plans.

: Previously if you are I qualified for a subsidy on health care.gov. We can only use those on an ACA compliant plan, right? My insurance is $273 a month is the market rate for my insurance. But I only pay forty dollars a month. And the reason I only pay 40 dollars a month is because most of that is covered by a combination of mostly federal and some state dollars that is that subsidy.

: Right.

: The way the states are allocating and running those is done mostly at the state level. And states are now able to apply for these “innovation waivers” and there is a possibility that you are going to be able to get a subsidy for these plans. So these.

: Interesting.

: Short term plans used to only be for a couple of months. Essentially they’ve been cropping up where now they’re for 364 days.

: OK. So just shy of a year.

: Yeah and they are renewable for up to three years. So, the big thing is with these plans, is with a normal health insurance plan they will be automatically renewed. Obviously things have been changing a lot. And so you year to year, a lot of the plans have been disappearing. But if you get sick with something through the year you’re still going to have health insurance next year – you can’t be dropped.

: Yea.

: With these short term plans none of that is a guarantee you’re almost guaranteed to get dropped if you do get sick. So you will not qualify for this plan the following year.

: So it only gets one use, essentially.

: Yeah I mean this is if you get sick with something costly.

: Right. So not a cold but some something serious that would require a lot of money.

: That then they expect that is going to be expensive in the future. So these short-term health insurance plans. The name is short-term, but the reason that a lot of people are redefining them as junk plans or catastrophic plans, is because they aren’t really short-term anymore.

: The term is really extending quite as long.

: So there is huge cost differences though right. So the average I think, the average adult woman that is the age of 40 is paying something like 400 dollars a month for health insurance possibly with a subsidy, that’s like the average monthly cost right now and across all of the exchanges and these catastrophic plans are can be in the range of 30 to 80 dollars a month. So, they they really can be quite a lot cheaper.

: yea.

: That being said, there is a lot of concern that people don’t know what they’re getting, and don’t realize that they don’t have a lot of protections with these, just kind of grabbing this one because it’s cheap not looking into the details. Yeah. So here’s the thing to know about short-term insurance. It is available in every state currently. But, we might see a flooding of products on the market under this new Trump administration rulings.

: Because under the new policy it’s more appealing to those so it can count as your ACA coverage.

: They’ll sell you anything that they want to sell you, right? And the idea that the reason insurance companies are interested in selling these kind of cheaper products is one these products have very little risk to them right because they’re not required to cover you. They can deny you if they think, they can – I couldn’t buy one of these, right? Because I have rheumatoid arthritis which is across the board a deniable condition.

: Because it’s a preexisting condition.

: Are very expensive to manage like my health and – like, I wouldn’t underwrite me, rihgt? If given a choice. And that is also true for anybody with HIV, AIDS, auto-immune disorder. A previous diagnosis of cancer within the past 10 years, except for in some cases, skin cancer. Asthma is a very common illness. diabetes – any, any of these things are illnesses where you are almost guaranteed to get denied. Pregnancy – pregnancy or otherwise expecting a child, you just will not be able to qualify for one of these plans. But, the insurers like them because they think that they’re getting people who are going to choose to opt-out of getting health insurance, because there is no penalty this year.

: Right?

: So they’re getting some money out out of you, rather than no money out of you.

: Oh I see. This is cheap and appealing to the people that would be worried about just dropping health care altogether.

: This is quickly updating so we don’t have a ton of details on this right now but, not every single state is going to allow you to get a subsidy for these plans. Obviously this is going to be a very state by state. California is actually filing a lawsuit and is attempting to ban these short-term health insurance plans across the board. We will see how that goes. If California, has some luck doing those rule changes we might see some other progressive legislatures choose to do that as well. Oregon is probably a good example of a state that might attempt to do that. That being said, health insurance is, health care is a large part of our industry in Oregon so it’s very possible that.

: The industry pushback will prevent that from happening. U-S-A.

: Quite simply, these are not the plans to get if you want coverage and you have a preexisting health condition, if you if you have one of those common deniable conditions – You can just search deniable conditions and probably find it.

: A list.

: You most likely will not be able to get coverage at all. Should you get one of these – if you’re like I’m super healthy, my insurance is crazy expensive and I but – I don’t you know, want to go bankrupt if I was to get hit by a car- is a great example.

: Should I get one of these? I’m not saying – I’m not going to recommend these plans as a good, good good health care, but I will say that they could be a good insurance product, similar to like how I recommend renter’s insurance and I recommend life insurance if you have a dependent. These could be a good stop-gap that you know prevents you from having to put up a massive gofundme if you get into a crash. That being said, I do think that the health care and coverage and asurety of the plans available that are ACA compliant is very good. And if you are middle income, you likely qualify for a subsidy that could really bring that cost down. And from a like, making the world, a better place – if you are a relatively healthy person and you can get one of those ACA plans – you are helping keep the system together overall. *laughs*.

: So this one’s going to be better than nothing but not great.

: Yea, so people that use inhalers like Will, and people that use expensive medications like me. We thank you. I think that wraps our show for today, Will.

: I think it does.

: Our producer is Will Romey and our intro music is by Aaron Parecki. I’m Lillian Karabaic, your personal finance educator and host. Thanks for listening. And till next time,

: remember manage your money doesn’t manage you.

Automatically convert audio to text with Sonix